Contents of this page may be automatically translated, we take no responsibility for the accuracy of the translation. Feel free to contact our customer support centre if you have any questions.

Here you can find information about what a mortgage is and how you apply for a mortgage. You can also read about what needs to be included in the application.

Apply through the e-service or by form

Use our e-service or form to apply for a mortgage. Please note that no original paper documents need to be sent by post if you use the e-service.

As a legal entity you cannot apply through the e-service the application has to be made by form.

To exchange one existing mortgage certificate for two or more mortgage certificates, use the form for exchange.

Keep this in mind when applying for a mortgage

- If previous mortgages are valid in more than one property, the new mortgage must be valid in the same properties.

- If previous mortgages are only valid in one property, then the new mortgage cannot be valid in other properties as well.

In the e-service Min fastighet (My property) you can see the existing mortgages that are valid in the property

When applying for mortgage you must pay stamp duty. It is two percent of the amount mortgaged. The amount is calculated based on even thousands of SEK, rounded off downwards. In addition to that there is an expedition fee of 375 SEK. You pay the stamp duty when you receive the invoice from us.

Stamp duty and expedition fees.

What is a mortgage?

To be able to use a property as security for example for a loan when buying a property an application for mortgage needs to be sent to us, provided that the existing mortgages on the property are not sufficient.

By doing so a certain amount of your property is mortgaged to the one you are borrowing from. As a proof of the mortgage, we issue a mortgage certificate.

What needs to be included in the application?

As a property owner you can apply for mortgage, in most cases the bank will help with the application, but the property owner is the applicant. If the property has more than one owner, they all must sign the application. When we have granted the mortgage, it is registered in the Land register.

This always needs to be included in your application:

- All the property designations that the application applies to

- The personal identification number of the property owner (if you have a Swedish identification number)

- The mortgage amounts

- The property owners’ signature and name in block letters

- Any consent or other documents showing that a consent is not needed.

If you are married, cohabiting (sambo), divorced or if someone else is applying for you there might be a need to attach additional documents.

Do you want to make a change in existing mortgages, for example exchange or relaxation?

You may want to change existing mortgages for many reasons. For example, you may want:

- a mortgage to be valid in more than one property

- to exchange one mortgage for two or more new mortgages

- merge several mortgages into one

- give a mortgage lower priority (reduce the priority order)

- release a property that has a joint mortgage with another property

- cancel an existing mortgage

- register a new mortgage certificate holder or remove an existing registration.

To apply for any of the above you need to fill out either the form for new mortgage /cancellation or the one for exchange. If you use the form for new mortgage / cancellation, then you explain in box number 5 on the form which mortgage you want to change and what kind of change you want.

If you want to transfer mortgages from one property to a new property

When mortgages are transferred from one or several properties to a new or several new properties then you can receive a reduction in the stamp duty according to Section 22 of the Swedish stamp duty act.

The requirements for reduction of stamp duty are:

- that you are the registered owner of all the properties

- that you apply for cancellation and new mortgage at the same time and that all the electronic mortgage certificates have been transferred to the Land registrations´ archive or that all the written mortgage certificates have been submitted with the application.

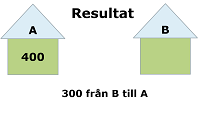

Then you only need to pay stamp duty for the difference between the amount of the new mortgage and the mortgages that have been cancelled. For each new mortgage you pay an expedition fee of 375 SEK.

Example

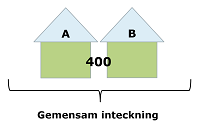

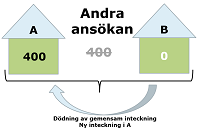

In the following examples you can see how mortgages are transferred from one or several properties to a new or several new properties.

You cannot transfer mortgages in one application

To transfer mortgages from one or several properties to a new or several new properties you need to make two separate applications. The same rule applies when you create interregional mortgages.

The second application, as described in 3 and 4, cannot be sent in before the mortgage certificate of the first application has been issued. Because the new mortgage certificate must be submitted /transferred to Land registration.

Questions and answers about the content of the application

If you are married, in most cases a consent to the mortgage application is required. This also applies if you are divorced, but have been married during the time you owned the property. If the property is private property, in most cases no consent is required. Instead, a document proving that the property is private property must be submitted.

In most cases, your spouse must give consent to the mortgage application. The consent must be in writing and can be given directly on application or in a separate document.

If you have received the property as private property through, for example, a gift or will, no consent is required. Then you need to send a copy of the gift certificate or will together with the application.

If the property is private property through a prenuptial agreement, you need to send a copy of the prenuptial agreement together with the application. If the property was a joint residence during the marriage, the prenuptial agreement is not sufficient. Then your spouse must give written consent.

Example of what a consent can look like (in Swedish, pdf, new window).

In most cases, the cohabitant does not have to give consent, but if a note has been made in the property register that the property is shared housing according to the Cohabitation Act, your cohabitant must give consent to the application for a mortgage.

Consent must be in writing and can be given directly on application or in a separate document.

Example of what a consent can look like (in Swedish, pdf, new window).

If you are divorced, you must show that your ex-spouse no longer has the right to marry in the property and does not have to give consent to the application for a mortgage. This also applies if you are already the sole property owner. You can show this in the following way:

- If you have divided the property, you can send a copy of the division agreement together with the application. It is good if you also send with a document that shows when the application for divorce was received by the district court.

- If you have received the property as private property through, for example, a gift or will, you can send a copy of the gift certificate or the will together with the application.

- If the property is private property through a prenuptial agreement, you can send a copy of the prenuptial agreement together with the application. Remember that the prenuptial agreement must be registered to be valid. If the property was a joint residence during the marriage, it is not certain that the prenuptial agreement is sufficient.

- If none of the above documents can be shown, your ex-spouse must give written consent to the application.

If someone other than the property owner is the submitter and submits the application (often a bank), the submitter's name and address must be stated. It is good if the administrator's telephone number is also included in the application. If the lender has a lender number, this must always be stated.

If you have borrowed money from a private individual or a small company and the lender wants a written mortgage as security for the loan, the lender can apply for a new mortgage. Keep in mind that it is still you who has legal title to the property who must sign the application.

It is extra important that the person who lent the money is stated as the invoice recipient and that you want a written mortgage deed, otherwise the Property Enrollment will issue a data mortgage deed to which the lender does not have access.

Then the association's statutes must be sent with the application. In addition:

- If the association is registered, a registration certificate from the Business Register, at Bolagsverket, must be sent with the application. Go to the Swedish Companies Registration Office's website (new window).

- If the association not is registered, minutes of who is on the board and who is allowed to sign the association's name must be sent with the application.

An estate does not have to apply for legal registration except if the property is to be transferred or mortgaged. In that case, the estate or the owners of the estate personally need to first apply for and be granted legal registration before a possible application for a mortgage can be granted.

Is the property owned by an estate and managed by the owners of the estate? Then all estate owners must sign the application for a mortgage / mortgage deed. A certified copy of the estate register, which must be registered with the Swedish Tax Agency, must also be sent with the application. The estate owners' spouses do not have to give consent to the mortgage.

Are any of the estate owners minors? Then permission from the chief guardian must be sent with the application.

Is the property owned by an estate and managed by an estate inspector? Then the estate surveyor must sign the application. The estate inspector's appointment must also be sent with the application.

Questions and answers about mortgage

In the service My Property, you will find detailed information about your own property, such as the number of mortgage deeds that the property has and how much it is mortgaged for.

If you have valid e-identification on your computer or Mobile BankID on your mobile device, you can log in and see your information online.

Private individuals can not join the system, which means that an individual, or a company that is not connected to the Pledge System, must have a mortgage deed in paper form, as a written mortgage deed, if they want it as security.

The holder of the written mortgage deed can request from Lantmäteriet to be registered in the Real Estate Register as the holder of the mortgage deed. Application for a note about the holder via our form (pdf, new window).

The holding note in the Real Estate Register only applies as long as you actually have the written mortgage deed physically in your possession. A data mortgage deed that is owner-registered (where the property owner's unsecured data mortgage deed is kept) is only available to the property owner, and a holding listing does not give the registered holder any right to the mortgage deed.

As the holder of a written mortgage deed, you should contact Lantmäteriet, Fastighetsinskrivningen when the holding note is to expire.

Notes on holdings do not disappear automatically if the written mortgage deed is handed over to someone else or if the written mortgage deed is converted into a data mortgage deed. Therefore, there may be outdated holding entries in the Property Register. If Lantmäteriet, Fastighetsinskrivningen discovers an outdated holding note, it will be cleared away.

When a bank applies for a mortgage in connection with an application for a loan and mortgage of the property, the mortgage deed is registered to the creditor's mortgagee number.

If you apply for a mortgage yourself and want a computer mortgage deed, it will be owner-registered and administered by Lantmäteriet. Data mortgage deeds that are owner-registered are only available to the lawful property owner or plot right holder.

If you have applied for a written mortgage deed, it will be sent by registered letter to the person specified as the submitter and invoice recipient in the application. If you have lost your mortgage deed, if you want to print your mortgage deed or register it, or convert a written mortgage deed into a data mortgage deed, or if you want to make an extract from the mortgage deed register, we can help you.

When an application for a new mortgage has been declared dormant, we send out a dormitory certificate to the person who is the submitter of the application.

The dormant certificate is a document of value that needs to be sent to us at the Property Registration in order for the dormant mortgage to be granted (according to Chapter 22, Section 5 of the Land Code). The purpose is to protect the person who lends money so that the wrong person does not get the granted mortgage.

If the rest certificate has been lost or has been destroyed, you can apply for it to be killed. It then happens in the same way as when you kill a written mortgage deed that has been lost.

For example, when you want to take out a loan from a bank in connection with buying a property, you may need to use the property as a mortgage, ie security for the loan. In order to use the property as security for the loan, in most cases the bank applies for a new mortgage, if there are not already enough existing mortgage deeds.

By doing so, a certain amount of the property will be pledged to the person you are borrowing from. It is still you as a property owner or plot right holder who is the applicant and you need to sign the application that the bank submits.

You can also apply for a new mortgage yourself, but then remember to contact your bank to ensure that an application has not already been submitted.

The mortgage is registered in the registration part of the property register following a decision by us. Thereafter, a mortgage deed is issued which is registered to the bank's mortgagee number. The mortgage deed is a security document and serves as proof that the mortgage has been taken.

Visit the Swedish Companies Registration Office's website (new window) to read about what it means to apply for a corporate mortgage, how big the stamp duty will be and how to kill a corporate mortgage.